Bitcoin dropped below $115K after hitting a record high. Inflation worries and profit-taking drove the fall, but long-term trust is still strong.

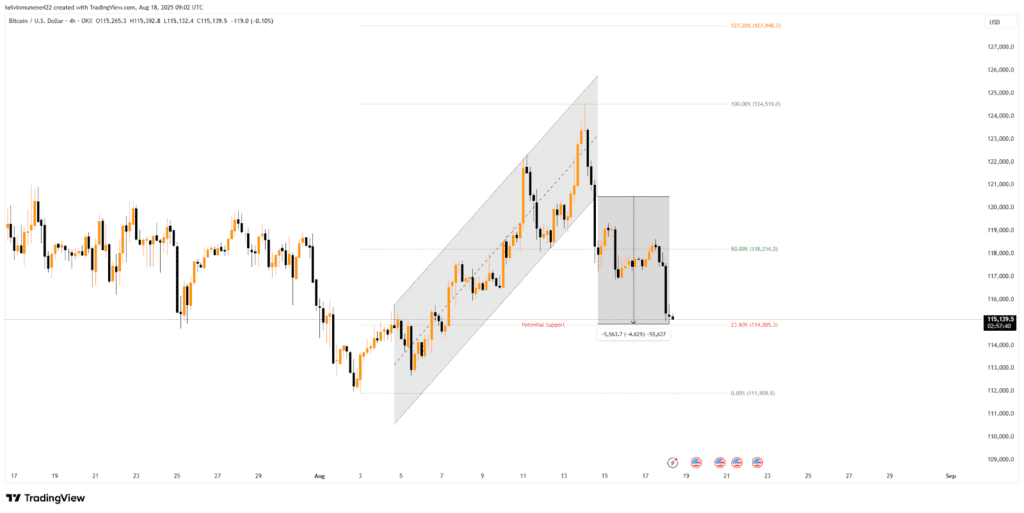

Bitcoin’s price has been highly volatile in recent weeks. On August 14, it hit a record high of about $124,457. Just a few days later, on August 18, it dropped below $115,000. The fall was around 7% in a short span.

Many investors used the 14 August peak as a chance to sell. On Saturday, profit-taking sales crossed $3 billion. These exits added pressure on the market.

Even with this drop, Bitcoin has shown strong growth over time. The price has doubled since last year. It has risen by about 26% in the early 6 months of 2025, showing the digital currency’s ability to recover after declines, but also how unstable it can be.

Let’s take a look at what the factors can be for the fall of Bitcoin. Several factors caused the recent fall:

- Inflation fears made investors sell their shares.

- Interest rate changes pushed money to safer assets.

- Automated systems sold more as prices dipped.

- Ethereum and other cryptos also fell.

The price swings affected Strategy Inc., too. Its stock fell about 8% in line with Bitcoin’s move. Since the company’s future is tied to Bitcoin, its share price often rises and falls together with the coin. Strategy Inc. has said it may keep funding new Bitcoin buys by selling shares or using credit, depending on market trends.

Strategy Inc. has bought more Bitcoin once again. The company added 430 Bitcoins for about $51.4 million. Each coin costs them around $119,666.

With this purchase, the company now holds over 629,000 Bitcoins. That is close to 3% of all Bitcoins in circulation. Only a few companies in the world own such a large share.

The table below shows the list of companies holding larger shares.

| Company | Bitcoin Holdings |

| Strategy Inc. (formerly MicroStrategy) | ≈629,376 BTC |

| Marathon Digital Holdings | ≈50,639 BTC |

| Galaxy Digital | ≈12,830 BTC |

| CleanSpark | ≈12,703 BTC |

| Coinbase (direct holdings) | ≈11,776 BTC |

| Tesla | ≈11,509 BTC |

Strategy Inc. has followed the same approach for years. It keeps buying Bitcoin at regular intervals. The company buys during both price highs and lows. To fund these moves, it often sells its shares.

At the same time, many long-time Bitcoin holders are selling. These early investors are cashing in profits after years of gains. This wave of selling could slow Bitcoin’s upward movement. It may also keep the price in a sideways trend for a while.

Still, companies like Strategy Inc. continue to buy. This shows that some investors believe in Bitcoin’s long-term value. But, Bitcoin holders should keep in mind that the price is always fluctuating, which means it can be high and low. So it is wise to invest in it after thorough research and proper market knowledge.